- HRCS India warns homebuyers of hidden legal traps in Real Estate

- Investigation by experts before buying is essential to ensure the safety of the investment

- Pre-Launch Offers and ‘Too-Good-to-Be-True’ deals carry high risk

- Home buyers must know that RBI guidelines clearly state that non-RERA projects are not eligible for home loans: D. Harshavardhan Reddy, CEO, HRCS India

Housing Requirements Customised Solution (HRCS) India has raised serious concerns over hidden legal risks in Hyderabad’s rapidly growing real estate market, cautioning homebuyers, investors, builders, and bankers against blindly trusting pre-launch and unverified property projects.

These warnings were issued during an online awareness webinar titled “Buying a Home Soon? Don’t Take the Risk Blindly”, this weekend and attended by over 100 participants, including property buyers, investors, industry professionals, and legal experts.

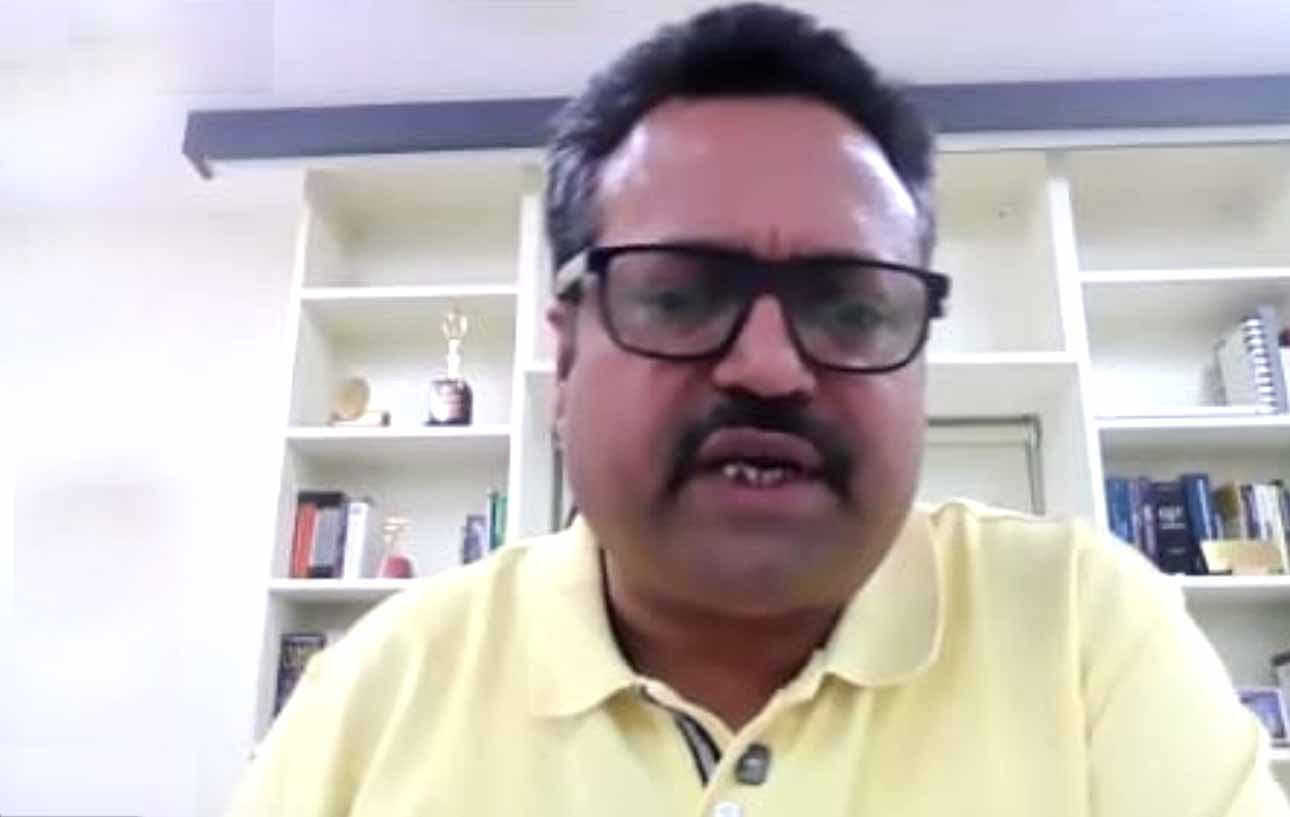

The session was led by D. Harshavardhan Reddy, CEO, HRCS India, LB Nagar in the city , who shared critical insights into common legal pitfalls faced by real estate buyers in Hyderabad and Bengaluru.

Loan approval is not legal approval, Reddy said very firmly. It is a costly misconception, he stressed.Addressing a widespread misconception, Reddy cautioned that bank loan availability should not be mistaken for complete legal clearance.

Until now, people believed that if a bank was willing to give a loan, the property must be legal. That assumption is dangerous,” he said. HYDRAA demolitions sufficiently proved this argument.

Banks and NBFCs often approve loans based on buyer indemnity, which means the buyer alone bears the legal risk if something goes wrong, he reminded.

He emphasised that in such cases, buyers remain fully responsible for disputes related to land title, approvals, or regulatory violations.

Pre-Launch Offers and ‘Too-Good-to-Be-True’ deals carry high risk, he cautioned prospective home buyers.

The webinar also highlighted the growing risks associated with pre-launch projects and discounted offers that lack statutory approvals. Citing recent real estate scams, including incidents reported in September, HRCS India warned that unapproved developments often suffer from missing layout permissions, unclear land titles, and absence of guarantees.

Investing before approvals is essentially placing your money in a high-risk zone, Reddy noted. Until the project is completed and verified, the buyer carries all the uncertainty.

For example, during the Hyderabad demolition drive earlier this year, several homebuyers found themselves in distress when properties they had invested in were marked for removal due to lack of clear approval and title verification. Many reported financial losses and legal uncertainty as construction came to an abrupt halt, with buyers left to navigate recovery and compensation processes.

RERA registration is non negotiable, Reddy says. Underscoring the importance of compliance, Reddy reiterated that any project with more than eight units—apartments, villas, or plotted developments—must be registered under RERA.

RERA registration ensures: 70% of customer funds are secured in an escrow account. Accountability of builders and landowners is ensured. It also ensures legal protection for buyers in cases of delay, fraud, or quality issues

He also pointed out that RBI guidelines clearly state that non-RERA projects are not eligible for home loans, even though some lenders may still proceed based on buyer indemnity.

The CEO Mr D. Harshavardhan Reddy, of HRCS India called for responsible transactions and verified properties.

HRCS India urged buyers, builders, landowners, and bankers to support and transact only in verified, legally compliant properties to reduce financial stress and the growing burden of Non-Performing Assets (NPAs) on the banking system.

“Let’s promote verified properties. Let’s transact only with verified properties. And let’s work while respecting the law,” Reddy said.

Concluding the session, Reddy delivered a powerful analogy that resonated strongly with participants: “Buying property without legal verification is like driving a car without brakes. You might move fast, but you can’t stop safely.”, Reddy gave a strong warning to Homebuyers.

HRCS India reaffirmed its commitment to empowering buyers and stakeholders through continuous education, stressing that legal due diligence is a necessity, not a choice. The organisation stated that it will continue to host such awareness sessions, inspired by the heart-wrenching challenges and legal distress faced by many property owners who invested without proper verification.